Pumped-storage hydropower at abandoned pits could help make wind and solar power available anytime

ADELAIDE, Australia—Mining operations that contributed to greenhouse-gas emissions could soon help to cut them.

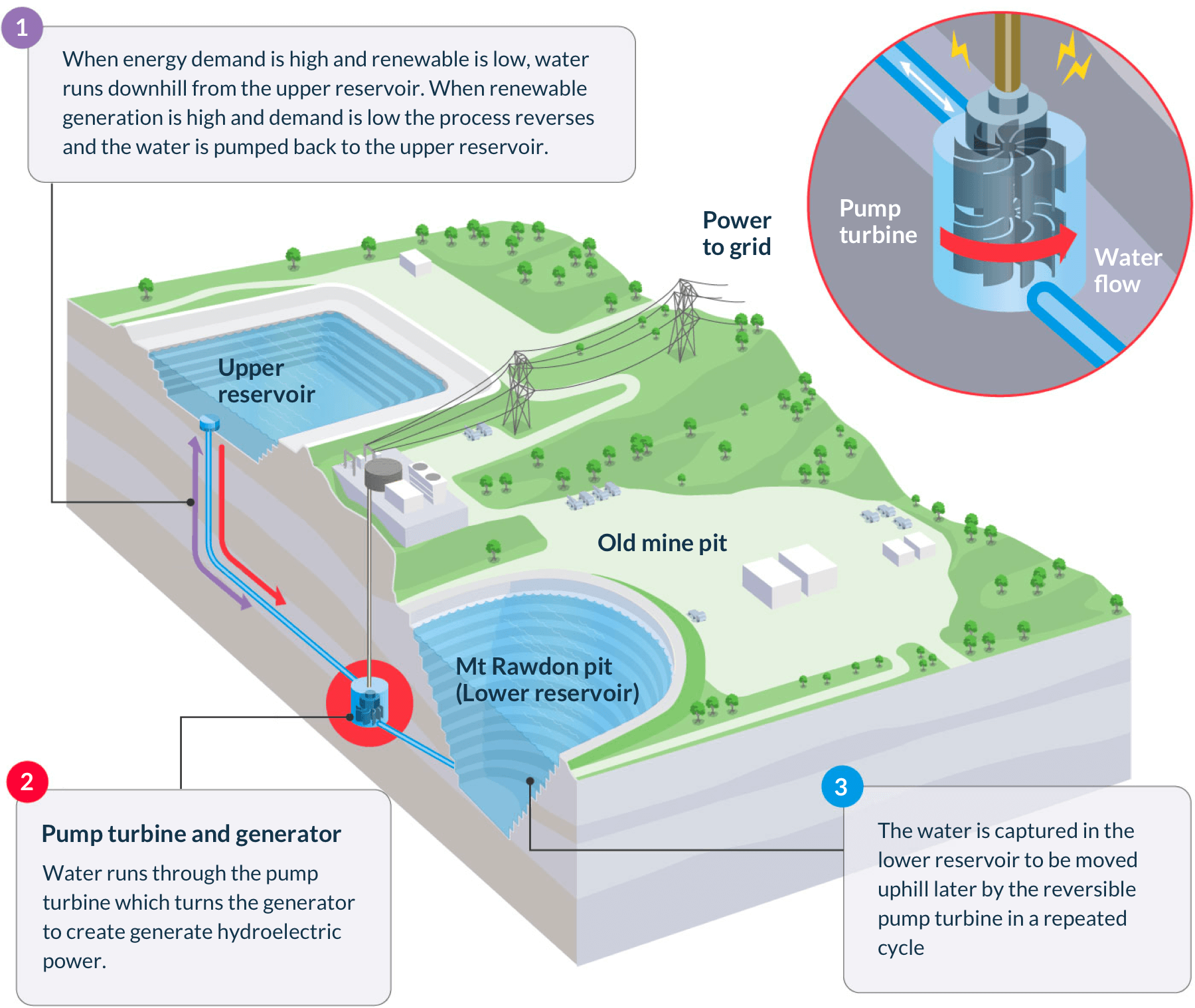

Around the world, companies are seeking to repurpose old mines as renewable-energy generators using a century-old technology known as pumped-storage hydropower. The technology, already part of the energy mix in many countries, works like a giant battery, with water and gravity as the energy source. Water is pumped uphill to a reservoir when energy supply is plentiful. It is released and flows downhill through turbines generating hydroelectric power when electricity demand is high or there are shortages of other types of power. Finally, the water is captured to be pumped uphill again in a repeated cycle.

Surface and underground mines hold potential as reservoirs for the water, and could be developed with a lower environmental impact and upfront costs than building such plants from scratch, experts say.

Proposals for pumped-storage hydropower projects in Australia, the U.S. and other markets are gaining momentum, fueled by accelerating investment in renewables and by energy-security concerns following Russia’s invasion of Ukraine and recent spikes in electricity prices.

“It seems like it’s easier to raise money for pumped hydro than it is for a gold project at the moment,” says Jake Klein, executive chairman of Evolution Mining Ltd., an Australian gold producer.

Investor appetite

A pumped-storage hydropower plant is being planned for a disused mining site in Estonia as the country seeks to shore up its energy system. PHOTO: EESTI ENERGIA

Pumped storage could help solve one of the biggest hurdles in renewable energy—that solar and wind farms don’t always produce electricity when it is needed. Governments so far have provided the lion’s share of funding to assess how mines can be transformed into pumped storage, but investors appear increasingly eager to make investments that support the energy transition away from fossil fuels.

The International Hydropower Association estimates total pumped-storage capacity could more than double to roughly 375 gigawatts by 2030. While China is likely to account for almost half of that growth, 21 countries have targets for pumped-storage hydropower in their energy policies or climate action plans, says Rebecca Ellis, the industry association’s energy policy manager.

Still, some experts caution there aren’t many examples of repurposing disused mines at scale, and several proposed projects, including in Australia and Europe, have not succeeded. Critics of the idea argue that most mines aren’t big enough or ideally located to warrant using a mine site versus building a pumped-storage facility on undeveloped land.

Mining and hydropower-development companies counter that repurposing mines is less costly than building new reservoirs. They also argue that converting sites to pumped-storage plants could give investors an economic incentive to end mining operations responsibly, and that cash from new energy operations could help pay to improve the surroundings.

Another reason to go with pumped storage, these companies say: For communities that have relied heavily on mines, often in rural or remote areas, the projects could ensure some local jobs and revenue remain after mining ceases.

Mining Renewable Energy

Old mines could soon be tapped to generate electricity through the use of pumped-storage hydropower. Here’s how it works.

Golden opportunity?

Evolution Mining wants to convert its Mount Rawdon gold mine in Australia’s Queensland state to a pumped-storage plant with one to two gigawatts of power generation capacity, depending on demand, after the operation winds down later this decade. The company says it could supply as many as two million homes daily during peak periods.

One factor in pumped storage’s favor is the number of mines that are tapped out already, or will be soon. A recent report by Roman Sidortsov and several other professors at Michigan Technological University, identified roughly 1,000 suitable sites for the technology across 15 states in the U.S.

The Biden administration in June launched a $500 million program to transform mines into clean-energy hubs. Types of projects that can apply include pumped-storage hydropower. The Energy Department also has noted that President Biden’s bipartisan infrastructure law provides $11.3 billion in abandoned-mine land-grant funding over 15 years to eligible states and Native American tribes in part “to revitalize coal communities.”

Some companies hope this will spur pumped-storage proposals, creating a future industry for communities in coal-mining states in particular.

In Bell County, Kentucky, hydropower company Rye Development has proposed a $1 billion-plus project at a former coal mine that could produce about 287 megawatts for eight hours, enough to power almost 230,000 homes. Other proposals include a 1.3-gigawatt pumped-storage redevelopment of the disused Eagle Mountain iron-ore mine in Riverside County, Calif., backed by NextEra Energy Inc.

Past and present

The concept of reimagining mines as hydropower batteries isn’t new. The 1.7-gigawatt Dinorwig power station in northern Wales, nicknamed Electric Mountain, was built in the 1970s in an old slate mine. Run today by a joint venture between French utility Engie SA and Bermuda-based Brookfield Renewable Partners, Dinorwig plays a vital role in the supply of electricity to the U.K.’s national grid. The site provides additional power quickly at times of system stress or intermittent supply, an Engie spokeswoman says.

Still, several promising pumped-storage projects have failed to advance. And plenty of critics are skeptical about the overall potential.

Germany’s RAG AG, a former coal-mining company and a subsidiary of RAG-Stiftung, abandoned plans to use the technology at the Prosper-Haniel underground mine, closed in 2018, because it couldn’t find an investor. Thai coal-mining and power company Banpu PCL recently ended studies into repurposing an underground mine in Australia’s New South Wales state. Banpu concluded in July that a large surface reservoir, capable of 20-plus hours of storage, was needed to make a project financially viable. It worried that battery technology is rapidly developing to extend duration and that there are future risks from other competing technologies including hydrogen and so-called vehicle-to-grid, where parked electric vehicles can be called on for power, especially during peak-demand periods.

One critic of using mine sites for pumped-storage hydropower is Andrew Blakers, an engineering professor at the Australian National University. Prof. Blakers, who received government funding to create an atlas of potential locations for pumped storage, argues that undeveloped sites, where a plant can be laid out in the optimum way, are more economical than former mines.

“No surprise,” he says, “something that’s 10 times the size of something else is going to cost a lot less per unit.”

To make sense financially, he says, pumped storage typically requires large scale, a big difference in altitude between the upper and lower reservoirs, and a short, steep slope—a combination not always found in mine sites.

Markus Brokhof, chief operating officer of Australia’s AGL Energy Ltd., by contrast, believes the economics of former mines and smaller projects can stack up. Utilities need more decentralized storage, but batteries typically have a short, roughly two-hour life and need to be more frequently replaced, he says. Creating pumped storage from scratch, he adds, is a huge investment, with considerable environmental and construction risk.

In September, AGL and Japan’s Idemitsu Kosan Co. secured government funding to study how to turn the century-old Muswellbrook coal mine in New South Wales into 250-megawatt, eight-hour pumped storage. “We believe it is the cheapest option,” Mr. Brokhof says, although the venture hasn’t published its estimate of the cost. “You don’t have to move millions of cubic meters” of rock, he says.

To quiet skeptics, the industry needs a modern success story it can hold up to investors. Experts are watching efforts by Genex Power Ltd. to link two abandoned gold pits near Kidston in Queensland, which would be the first pumped-storage project to become operational in Australia in nearly 40 years.

Genex hopes to plug the 250-megawatt facility, which aims to create enough energy to power roughly 143,000 homes for eight hours, into the grid in late 2024 to operate for 80 years. The total construction cost of the plant is expected to be about $500 million.

“I think governments appreciate the story of repurposing an old mine in this way,” says James Harding, Genex’s chief executive.

Source: https://www.wsj.com/articles/store-renewable-energy-old-mines-11668116754